Rigetti Computing Insider Sellers Miss The Bus As Stock Jumps 13%

Last week, the stock of Rigetti Computing, Inc. (NASDAQ:RGTI) is up 13%, but insiders who sold $209k worth of stock in the past year may be in a better position. Selling at an average price of US$1.35, which is higher than the current price, may have been the wisest decision for these insiders as their investment would have been lower than when they were selling.

Although insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider trading completely.

Check out our latest Rigetti Computing review

Last 12 Months of Internal Operations at Rigetti Computing

Senior Advisor and Corporate Secretary, Richard Danis, has made the largest insider sale of the past 12 months. That one trade was for shares worth $91k at a price of US$1.97 each. Although insider trading is a bad thing, for us, it is worse if the shares are sold at a lower price. The silver rate is that this sale happened above the recent price (US$0.85). So it may not provide much information about internal reliability in the current situation.

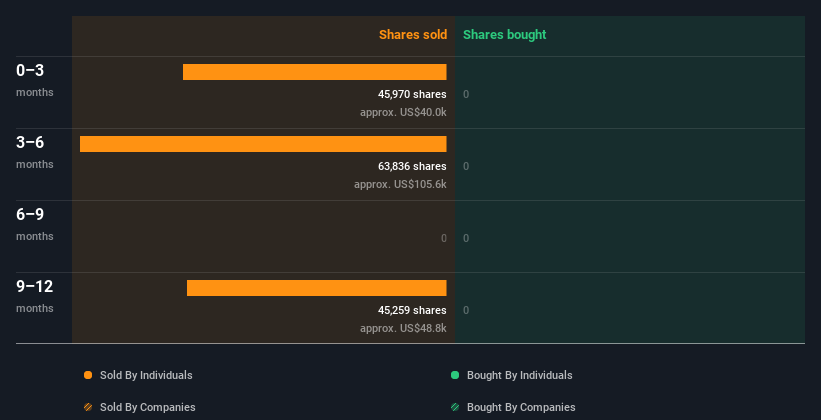

Last year, Rigetti Computing employees did not buy the company’s stock. You can see a snapshot of internal processes (by companies and individuals) over the past 12 months, below. If you click on the chart, you can see all individual transactions, including share price, individual, and date!

I’ll like Rigetti Computing better when I see a lot of internal purchases. While we wait, check this out for free a list of low-value and small-cap stocks with high, recent, and insider prices.

Rigetti Computing Insiders Sell The Stock

We’ve seen some insiders sell Rigetti Computing in the past three months. Insiders sold only $40k worth of US shares during that time. Neither the lack of buying nor the presence of selling is encouraging. But marketing is not important enough to be used extensively as a brand.

Inside the Owners of Rigetti Computing

I like to look at how many people own shares in the company, to help determine my view of how they fit with the insiders. I think it’s a good sign if insiders have a large number of shares in the company. Our data shows that Rigetti Computing employees own approximately $6.7m worth of US shares (4.3% of the company). We generally prefer to see the top quality of our owners.

What Can the Changes Inside Rigetti Computing Tell Us?

Although there hasn’t been anyone buying within the past three months, there have been sales. However, the sales are not big enough to worry us at all. We are a little wary of insiders at Rigetti Computing. And we don’t intend to own the people inside us to give us comfort. Although it is good to know what is happening with the stock and insider dealings, we make sure that we also consider the risks facing the stock before making any investment decision. Example: We saw 3 warning signs for Rigetti Computing you should be aware.

But be aware: Rigetti Computing may not be the best stock to buy. So check this out for free list of interesting companies with high ROE and low debt.

For this article, insiders are people who report their transactions to the relevant regulatory body. We are currently responsible for open market transactions and private opinions of direct interests only, but not from other or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

#Rigetti #Computing #Insider #Sellers #Bus #Stock #Jumps